In a perfect world, all business owners, be they painting professionals, electricians, or handymen, would be trained accountants and know exactly which levers to pull, and when, to ensure long-term profitability.

Whether you are thinking about purchasing expensive equipment, hiring more people, or expanding into a new market or service, your balance sheet is the most reliable source from which to make important business decisions.

- Step 1: Ask customers what times they are available, then upload the request into Route Manager.

- Step 2: Confirm the planned arrival time – and stick to it.

- Step 3: Equip your sales and customer support team with visibility into live ETAs via GPS tracking.

- Step 4: Use Route Manager 360 notes to stay updated on customer satisfaction.

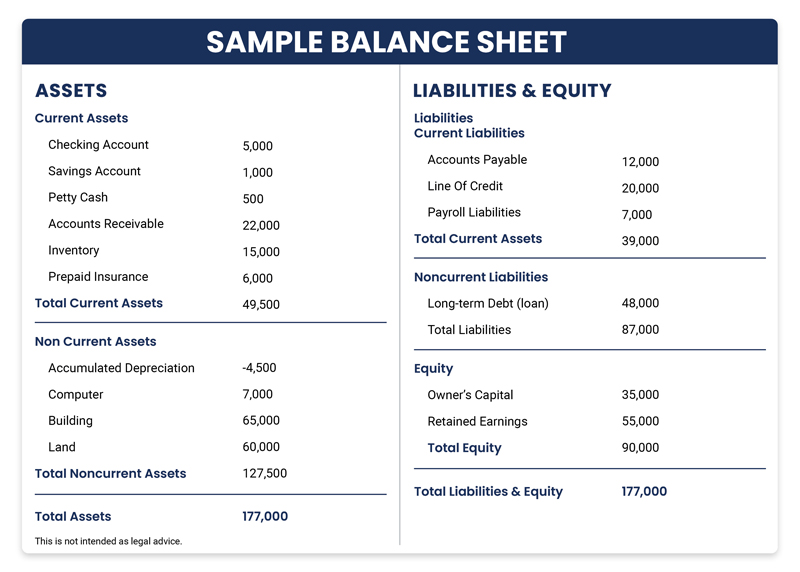

The Building Blocks of a Balance Sheet

There are three basic elements of a balance sheet:

Assets

Assets are the business’s valuables. In general, it’s cash on hand but also anything you can use to make money. It can be tangible like a company truck, or inventory, or intangible like trademarks, patents, or investments.

Liabilities

Liabilities are the business’s obligations to pay out like a car loan, commercial rent, money owed to suppliers, or for future services owed. It also includes payroll and taxes.

Equity

Equity is the business’s net worth. It’s the amount of money that remains after the assets have been used to pay off all of its liabilities. This is the true value of the business and belongs to its owners or shareholders.

Your Financial Compass

A well-managed balance sheet will help you navigate business opportunities and risks, in real time. Understanding how to accurately capture financial details could make or break your business. Over-valuing assets may make your financial position look more positive than it is and could lead to damaging decisions. Be honest with the numbers because misrepresentations or “padding” will inevitably create unnecessary risk.

For example, assets are only as valuable as the market dictates, at that moment. Be mindful to report your assets at their current cash value — that is, if you had to sell things like your work trucks or equipment, what would it be worth, at that moment?

When it comes to your liabilities, you should stay focused on monies that are due in the next 12 months. This includes things like rent, taxes, interest-bearing loans, and credit cards. The goal is to have accurate and timely financial data that allows you to monitor expenditures, investments, and other financial matters to increase your business’s equity.

How To Create A Balance Sheet

According to the experts at Harvard Business School Online, there are four critical steps to preparing your balance sheet for the first time.

Step 1: Set a Reporting Schedule

For many businesses, that is quarterly in March, June, September, and December but it can be any date you decide.

Step 2: Split and List Assets

Tally “Current Assets” like cash, AR, and inventory and “Non-current” assets like property, and software, and listed separately so the source is clear. Together, these represent your total assets.

Step 3: Split and List Liabilities

Tally “Current Liabilities” like AP, accrued expenses, deferred revenue, the current portion of long-term debt, and “Non-current” liabilities like leasing and debt. Together these represent your total liabilities.

Step 4: Calculate Shareholders’ Equity

While the methods for calculating net worth might be different for a sole proprietor versus a publicly traded company, the formula is the same. Net Worth = Total Assets + Equity – Total Liability.

Getting the Most Out of a Balance Sheet

Knowing how to decipher each part of a balance sheet can give you valuable insight into the state of your business finances. Understanding these three elements can allow you to make better-informed decisions for your business. Having an up-to-date balance sheet is crucial to your ability to accurately convey your business’s current financial standing and provide stakeholders with confidence in the business’s future success.

Powering Better Business Decisions

While the information contained in a balance sheet may seem basic, the insight you gain is invaluable and will help you take better control of future performance. Armed with a true and accurate balance sheet, you can make smarter investments, take on debt with a clear understanding of how long, and at what cost, you can afford to repay it, and other strategic decisions like expanding or cutting operational costs. Knowing these details will help ensure your business remains profitable without putting your financial stability at risk.

Balance Sheets & Cash Flow

Cash flow is possibly the most important element for business owners. Cash flow refers to all money coming in and out of an organization or business — in other words, cash flowing in and out of a business is a cycle of assets and liabilities. As such, it’s evident that cash flow can play a big role in what you see on your balance sheet.

Being able to predict your cash flow proves to be crucial when planning future purchases or making adjustments based on your balance sheet. For instance, a dip in your business’s equity can certainly be a cause for concern but isn’t such a red flag if you know you’re about to enter into your busy season and can count on an increase in positive cash flow.

Similarly, if your liabilities are high due to an increase in outstanding invoices, it can be an indicator that your business needs to be more efficient in collecting payments. This is likely a sign that your business needs to better communicate with customers, provide them with easier payment options, or put more work into getting customers set up with automatic payments to keep cash flow steady.

As a key financial document, a balance sheet provides insights into your company’s overall financial health. By understanding how to create and read a balance sheet, you can make more informed business decisions about organizational spending, investiture, and growth. With this data close at hand, you can begin laying strategies and making decisions that propel your business forward and accelerate your cash flow. To start taking control of your finances and maximizing your money, learn more about WorkWave’s financial tools and how they can help your business today!